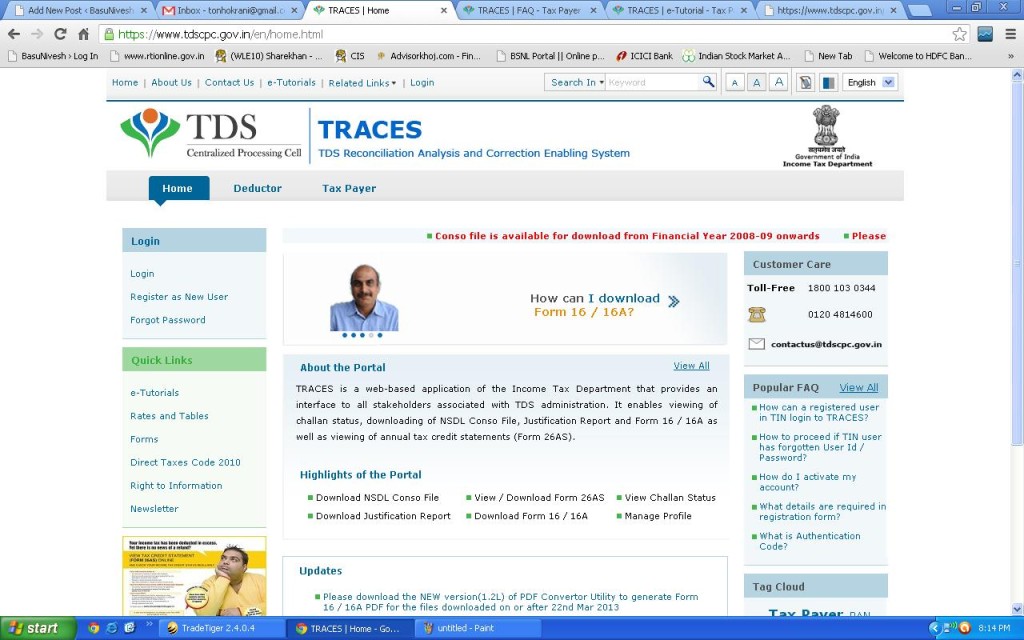

For opening the PDF, you may also be required to enter the password, as instructed therein. You can view the details online or download the pdf as well. In this case, the users will be required to enter the User ID, password and TAN No., Click on the same and then you will be redirected to the NSDL website. On the left side, you will get the option to view Form 26AS. Once you are registered, log in with your User ID and password. You need to be a registered user for this. In case you log in through income tax site: Step 1: Go to the income tax site/TRACES: The tax credit will be available on the basis of Form 26AS only, so one needs to thoroughly check the amount of TDS to be claimed before filing the income tax return or making payment for self-assessment tax.įorm 26AS is a form that you are required to download by logging into the income tax site or TRACES as shown below: Thereby, Axis Bank will be required to revise the TDS return, then the amount of TDS will be shown in Form 26AS.Y, in this case, can inform the deductor/ Axis Bank in this case. In case of any mismatch, which is usually due to the wrong PAN No. You can always cross-check Form 26AS and TDS certificate to see if they tally with each other.Y will receive TDS certificate from Axis Bank after the submission of the TDS return. Y will be able to calculate the total TDS deducted for the entire financial year and claim it accordingly. On submission of the TDS return by the Axis Bank, the details will appear in Form 26AS of Mr. The TDS return contains the details of the interest amount, TDS paid, PAN No.4000 is deducted for the period of April – June which will be shown in the TDS return filed by the Axis bank in July. The quarterly interest paid by the bank is Rs. The credit of TDS is given on the basis of the TDS return submitted and the credit of that deducted amount is shown in Form 26AS.

Self Assessment Tax or Advance Tax Paid.What is 26AS Form?įorm 26 AS is a consolidated statement that provides the complete details of the following: To cross check as well as to prevent any miscalculation with respect to the total unclaimed TDS amount, you need to simply download Form 26AS. Hence, you end up calculating wrong tax amount. Now in case you have multiple deductions during the year, it becomes very difficult to trace the total amount of TDS paid. interest income, dividend income, royalty income, income from professional services etc. You will see that TDS is deducted on several sources of income i.e. On the basis of the TDS returns submitted, the deductee can avail the claim at the later stage. The underlying purpose of depositing the TDS return is to inform the Government about the total amount of payments made, nature of payments, deductee details etc. After this, the deductor will submit TDS return on a quarterly basis with the NSDL. (deductor) will be required to deposit the TDS amount with the Government.

0 kommentar(er)

0 kommentar(er)